In this issue

WheelsOn raises $12.5 million to modernise UAE car rentals

02/09/2025

WheelsOn, the UAE’s mobile-first car rental platform, has closed a $12.5 million funding round, including $2.2 million in equity from a group of MENA-focused private investors, including partners of Xploration Capital, $6.5M for a fleet expansion round and $4M financing from local banks.

This latest round brings WheelsOn’s total funding to $12.5 million, pushing its valuation near $30 million.

Intella bags $12.5 million in oversubscribed Series A

02/09/2025

Intella, the market leader in dialectal Arabic speech intelligence, today announced it has closed $12.5 million in an oversubscribed Series A round led by Prosus, with participation from 500 Global, Wa’ed Ventures, Hala Ventures, Idrisi Ventures and HearstLab, the investment arm of Hearst Corporation.

The funding will accelerate Intella’s mission to power a digital AI workforce across the Arabic-speaking world.

Qatar backs US firm Anthropic’s $13bln fundraise

04/09/2025

Qatar Investment Authority (QIA) has invested in the latest $13 billion fundraise for artificial intelligence (AI) company Anthropic.

The sovereign wealth fund, which oversees around $557 billion in assets, confirmed the investment on Tuesday, but it did not disclose how much it has allocated for the US-based firm.

Aramco’s Wa’ed backs $12.5mln funding for AI startup Intella

09/03/2025

Saudi Arabia-headquartered Intella, an artificial intelligence start-up, has secured $12.5 million from investors including Aramco’s venture capital fund.

The funding round for the AI firm specialising in building AI models for Arabic dialects was led by Prosus and participated by Wa’ed Ventures, 500 Global, Hala Ventures, Idrisi Ventures and HearstLab

Taqa consortium secures $4 billion funding for two Saudi power plants

03/09/2025

A consortium including Abu Dhabi National Energy Company, known as Taqa, has secured $4 billion in financing for two power plants being built in Saudi Arabia, as the kingdom continues to address its increasing energy demand.

Taqa, Jera – Japan’s largest power generation company, and Saudi Arabia’s AlBawani Capital reached financial close for the construction of the Rihab ElAwal Power Company and Nawras Power Company

Abu Dhabi’s G42 to sell 2% stake in Presight AI via accelerated book build

04/09/2025

Abu Dhabi’s G42 is offering 2% of its shareholding in its subsidiary, Presight AI, to institutional investors via an accelerated book build (ABB). This will reduce G42’s stake in the big data analytics company from 70.5% to 68.5%.

The stake sale, which will be open to investors in several countries, is expected to boost Presight’s market position, as well as broaden and institutionalise the company’s investor base.

Linde acquires top industrial gas company in Middle East

01/09/2025

Linde, a leading global industrial gases and engineering company, has announced that it has completed its acquisition of Airtec, one of the largest industrial gases companies in the Middle East.

Linde previously owned a 49% stake in Airtec and through this transaction has increased its shareholding to over 90%. The acquisition enhances Linde’s presence across the GCC region, including Kuwait, UAE, Qatar, Bahrain and Saudi Arabia. Airtec produces industrial gases for customers across key end markets including energy, healthcare and manufacturing.

Linde’s integrated business in Middle East includes air separation units, CO2 plants, onsite gas generation facilities and additional infrastructure to produce industrial, medical and specialty gases.

Seraya closes $1.8 million seed in equity-debt mix

01/09/2025

Seraya, the Dubai-based hospitality startup creating a new standard in premium serviced accommodation, has raised $1.8 million in seed funding, bringing its total capital raised to $2.15 million. The round was led by a prominent KSA-based family office and DLL, a German family office, with participation from strategic angel investors. The funding includes a mix of equity and debt and will support Seraya’s next phase of growth as it expands across Dubai’s booming short-term rental market.

Obeikan Glass takes full ownership of Obeikan AGC for SAR 22.9M

01/09/2025

Obeikan Glass Co. signed an agreement, on Aug. 31, to acquire the remaining stake in Obeikan AGC Co., a joint venture (JV) where it holds 19% of shares. The glass manufacturer agreed to buy AGC France Holding’s 50% stake, or 3,500 shares, in the target company for $3.77 million (SAR 14.4 million). It will also acquire the 18.6% holding, or 1,302 shares, of Obeikan Investment Group (OIG), for SAR 5.26 million, and the 12.4% stake, or 868 shares, held by Saudi Advanced Industries Co. (SAIC), for nearly SAR 3.51 million.

Y Combinator leads Munify’s $3 million seed round

01/09/2025

Cairo-based fintech Munify has raised $3 million in a seed round led by Y Combinator, with participation from BYLD and Digital Currency Group, alongside other strategic investors. The funding coincides with Munify’s graduation from YC’s Summer 2025 batch, marking one of the few MENA fintech startups to join the accelerator in a cycle dominated by AI companies.

Indian start-up TransBnk secures $25mln, to enter Middle East

02/09/2025

India’s fintech start-up TransBnk has secured $25 million to fund its expansion in the Middle East and Southeast Asia. The Series B funding round for the Mumbai-based transaction banking platform was led by Bessemer Venture Partners, with participation from existing investors 8i Ventures, Accion Venture Lab and GMO Venture Partners, as well as new investors Arkam Ventures and Fundamentum Partnership.

Basata Holding to deploy $7 million investments in Egypt

09/03/2025

Basata Holding for Financial Payments S.A.E., the leading e-payment services company in Egypt, announced plans to invest approximately USD 7 million in 2026 as part of its strategy to strengthen its market position. The company revealed that it is currently evaluating potential acquisition opportunities within its regional expansion plans, with final decisions expected before the end of this year.

Basata currently serves more than 120,000 merchants daily and aims to increase this figure to 150,000 merchants by the end of the year, reflecting its confidence in expanding its customer base and strengthening its role as a key player in Egypt’s digital payments sector.

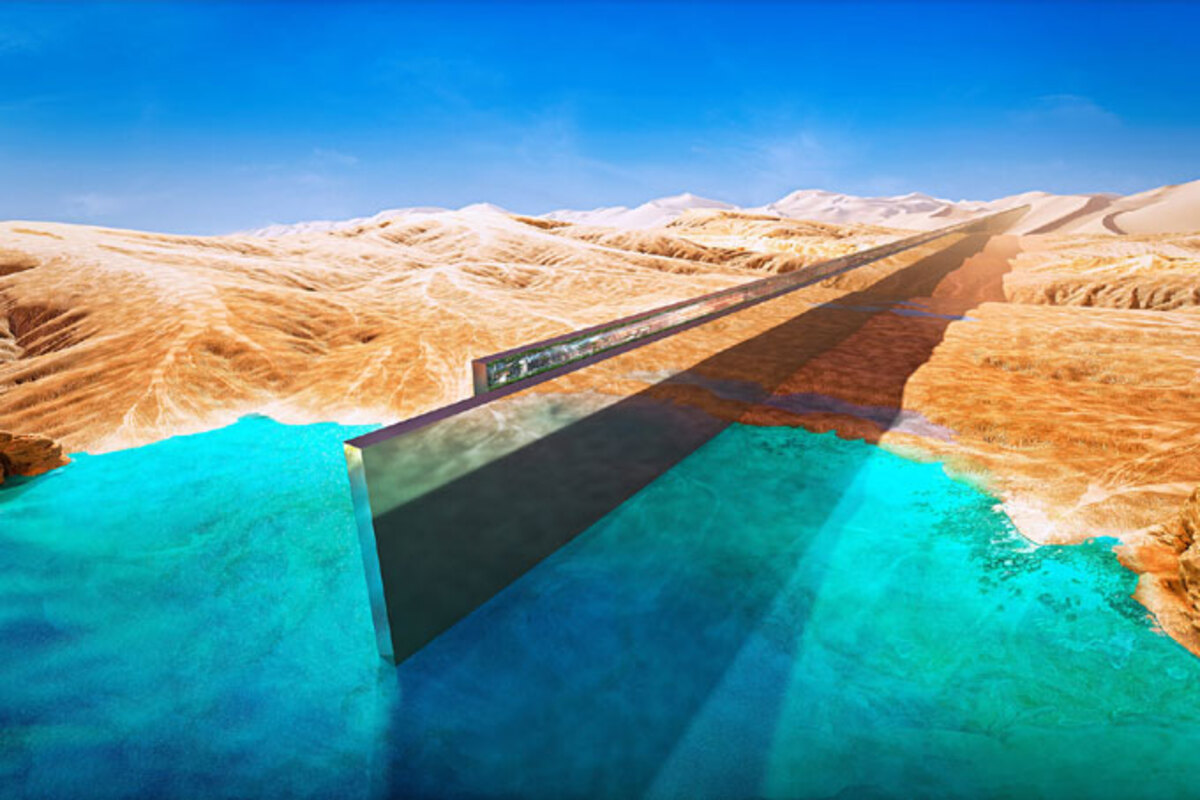

$1 trillion investment pipeline reshaping Saudi urban, economic landscape

01/09/2025

Saudi Arabia’s infrastructure ambitions are setting new international benchmarks, with projects that not only meet domestic needs but also position the kingdom as a hub for international trade and investment, said leading industry experts ahead of Global Infrastructure Expo.

Adnoc Logistics welcomes new shareholders following $317m share placement

03/09/2025

Adnoc Logistics and Services plc (Adnoc L&S / the Company), a global energy maritime logistics company, today announced the successful completion of a $317 million institutional placement of approximately 222 million shares, representing 3% of its total share capital, by Adnoc Group.

The placement was approximately seven times oversubscribed, one of the highest levels recorded for a regional secondary offering, underscoring strong investor confidence in Adnoc L&S’s strategic direction, financial resilience, and long-term growth outlook.

Bahrain EDB signs MoU with Egypt’s GAFI to enhance investment ties

04/09/2025

Bahrain Economic Development Board (Bahrain EDB) has signed a memorandum of understanding (MoU) with the General Authority for Investment and Free Zones (GAFI) Egypt to deepen their investment cooperation.

The agreement, signed in the presence of His Royal Highness Prince Salman bin Hamad Al Khalifa, the Crown Prince and Prime Minister, during his official visit to Egypt, highlights the shared commitment of both nations to strengthening their long-standing strategic investment partnership.

Bahrain EDB signs MoU with Egypt’s GAFI to enhance investment ties

04/09/2025

Bahrain Economic Development Board (Bahrain EDB) has signed a memorandum of understanding (MoU) with the General Authority for Investment and Free Zones (GAFI) Egypt to deepen their investment cooperation.

The agreement, signed in the presence of His Royal Highness Prince Salman bin Hamad Al Khalifa, the Crown Prince and Prime Minister, during his official visit to Egypt, highlights the shared commitment of both nations to strengthening their long-standing strategic investment partnership.

The strong trade relationship between Bahrain and Egypt is reflected through the growth of bilateral non-oil trade, which reached $460.5 million in 2024. In the same year, Egypt ranked as Bahrain’s 14th largest non-oil import partner and 6th largest export destination. Egyptian investments in Bahrain have been primarily concentrated in professional, scientific, and technical services, in addition to the finance and insurance sectors.

Dubai-based Sidara agrees takeover of Wood Group in $292m deal

01/09/2025

Wood Group, a UK-based global oilfield services enterprise, has agreed to a 216-million-pound ($292 million) conditional takeover bid from Dubai-based Sidara, the companies said. The agreement ends a pursuit that spanned more than a year and involved multiple offers and rejections. Under the 30-pence-per-share offer, Sidara will assume $1.6 billion of Wood Group’s debt and inject $450 million of cash into the company.

216 Capital invests in Tunisia’s Addvocate.AI

02/09/2025

216 Capital announces a new strategic investment in Addvocate.AI, a Franco-Tunisian startup specialised in optimising sales performance with artificial intelligence. With the exponential rise of artificial intelligence, the sales sector is entering a new era of smart automation. Today, having a digital copilot capable of managing and optimising every lever of sales performance is no longer a dream—it is a reality made possible by Addvocate.AI, the startup redefining intelligent sales.

Justyol raises $1 million funding to drive regional growth

02/09/2025

Justyol, the pioneering cross-border e-commerce platform transforming digital commerce across North Africa, today announced the successful completion of a $1 million strategic funding and financing package. The package was structured with $400,000 in strategic equity investment from a distinguished angel investor, demonstrating strong confidence in Justyol’s growth potential and market position.